Hedge Funds, Private Equity, and Funds of Funds: Navigating the Labyrinth of Alternative Investments

The world of investing extends far beyond the familiar realm of stocks and bonds. Alternative investments, such as hedge funds, private equity, and funds of funds, have gained significant prominence in recent years. These sophisticated investment vehicles offer potential returns that may outpace traditional asset classes but also carry unique risks. Understanding the intricacies of these alternative investments is crucial for informed financial decision-making.

Hedge Funds: Taking Calculated Risks

Hedge funds are actively managed investment pools that employ advanced strategies to generate returns. These strategies often involve hedging, which aims to reduce risk and enhance returns. Hedge funds typically invest in a wide range of asset classes, including stocks, bonds, commodities, and currencies.

4.8 out of 5

| Language | : | English |

| File size | : | 2700 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 285 pages |

| Screen Reader | : | Supported |

Key Features:

* Diversification: Hedge funds offer broad diversification across multiple asset classes, reducing the overall risk profile. * Sophisticated Strategies: They employ complex strategies, such as arbitrage, leverage, and short selling, to exploit market inefficiencies. * High Fees: Hedge fund management fees tend to be higher than traditional investment funds, reflecting the complexity of their strategies.

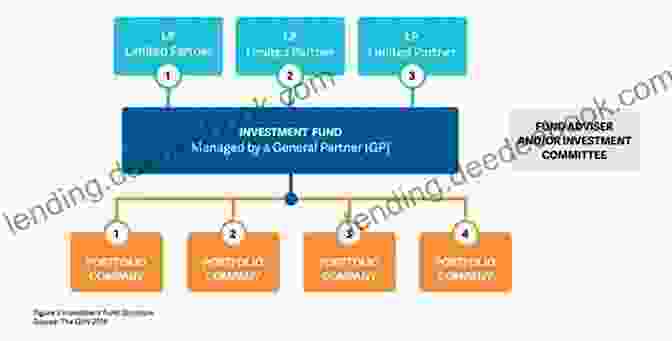

Private Equity: Investing in Private Companies

Private equity funds invest in private companies, typically those not listed on public stock exchanges. These funds provide capital to companies during their early stages of development or growth. Private equity investments are typically long-term, with a horizon of several years.

Key Features:

* Growth Potential: Private equity targets companies with high growth potential, offering the opportunity for significant returns over the long term. * Direct Investment: Investors directly invest in the companies, gaining a stake in their future growth and profitability. * Illiquidity: Private equity investments are illiquid, meaning they cannot be easily sold or redeemed.

Funds of Funds: Diversifying Alternative Investments

Funds of funds (FoFs) provide investors access to a diversified portfolio of hedge funds or private equity funds. By investing in a FoF, investors can spread their risk across multiple underlying funds and investment strategies.

Key Features:

* Diversification: FoFs offer diversification benefits by investing in a mix of hedge funds or private equity funds. * Professional Management: FoFs are managed by experienced professionals who conduct due diligence and select the underlying funds. * Lower Fees: FoFs generally charge lower fees compared to investing directly in hedge funds or private equity funds.

Risk and Return Considerations

Alternative investments such as hedge funds, private equity, and funds of funds offer potential rewards but also carry inherent risks.

* Risk: These investments may involve higher risks compared to traditional asset classes due to their complex strategies and illiquidity. * Return: The potential returns of alternative investments may fluctuate significantly and are not guaranteed. * Liquidity: Hedge funds and private equity funds typically have limited liquidity, making it challenging to access capital when needed.

Role in the Financial Landscape

Alternative investments play a significant role in the financial landscape by providing diversification, access to unique investment opportunities, and the potential for enhanced returns.

* Diversification: Alternative investments offer diversification benefits by investing in asset classes that may not correlate with traditional investments. * Growth Potential: Private equity investments target companies with high growth potential, providing opportunities for capital appreciation. * Alternative Income: Hedge funds may generate income through strategies such as dividend arbitrage and short selling, offering an alternative to fixed-income investments.

Hedge funds, private equity, and funds of funds offer unique investment opportunities that may complement traditional asset classes. These alternative investments provide potential for diversification, growth, and alternative income streams. However, it is imperative to understand the risks involved and invest only with a clear understanding of the strategies employed and the potential financial implications. By carefully evaluating the characteristics and risks of these alternative investments, sophisticated investors can harness their potential to enhance their overall investment portfolio.

4.8 out of 5

| Language | : | English |

| File size | : | 2700 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 285 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Chapter

Chapter Story

Story Genre

Genre E-book

E-book Newspaper

Newspaper Paragraph

Paragraph Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Dictionary

Dictionary Resolution

Resolution Borrowing

Borrowing Stacks

Stacks Archives

Archives Study

Study Research

Research Scholarly

Scholarly Lending

Lending Reserve

Reserve Reading Room

Reading Room Rare Books

Rare Books Study Group

Study Group Dissertation

Dissertation Storytelling

Storytelling Book Club

Book Club Theory

Theory Textbooks

Textbooks James Dawes

James Dawes Tom Kendrick

Tom Kendrick Ezra Levant

Ezra Levant Lee J Ames

Lee J Ames Phillip Spolin

Phillip Spolin Michael Schiavone

Michael Schiavone Nigel Farage

Nigel Farage Jae Kwang Kim

Jae Kwang Kim Greg Maxwell

Greg Maxwell Elizabeth Letts

Elizabeth Letts Bobbi Bullard

Bobbi Bullard Brian Floca

Brian Floca Molly Watson

Molly Watson Joanne Hillyer

Joanne Hillyer Laura Marie Altom

Laura Marie Altom Al Gore

Al Gore George Mentz

George Mentz Atewo Laolu Ogunniyi

Atewo Laolu Ogunniyi Robert Newman

Robert Newman Hien Luu

Hien Luu

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

T.S. EliotMarried to the Mafia: The Fallen Son — An Enthralling Tale of Love, Betrayal,...

T.S. EliotMarried to the Mafia: The Fallen Son — An Enthralling Tale of Love, Betrayal,... William ShakespeareFollow ·3.1k

William ShakespeareFollow ·3.1k Roy BellFollow ·10.6k

Roy BellFollow ·10.6k Liam WardFollow ·7.4k

Liam WardFollow ·7.4k Jorge Luis BorgesFollow ·5.1k

Jorge Luis BorgesFollow ·5.1k Jamal BlairFollow ·19.1k

Jamal BlairFollow ·19.1k Eli BrooksFollow ·17.3k

Eli BrooksFollow ·17.3k Chuck MitchellFollow ·11.6k

Chuck MitchellFollow ·11.6k Lord ByronFollow ·4.5k

Lord ByronFollow ·4.5k

Carson Blair

Carson BlairMy Second Chapter: The Inspiring Story of Matthew Ward

In the tapestry of life, where threads...

Graham Blair

Graham BlairFull Voice Workbook Level Two: A Comprehensive Guide to...

The Full Voice Workbook Level Two is a...

Darren Blair

Darren BlairEmbark on an Unforgettable Adventure: Exploring the...

Prepare yourself for an extraordinary...

Isaiah Powell

Isaiah PowellSoul Music: A Literary Odyssey Through Discworld

In the realm of fantasy...

4.8 out of 5

| Language | : | English |

| File size | : | 2700 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 285 pages |

| Screen Reader | : | Supported |