Introduction to Alternative Investments: Unlocking Diversification and Enhancing Returns

What Are Alternative Investments?

Beyond traditional stocks and bonds, alternative investments offer a diverse range of asset classes that can enhance portfolio performance. Unlike conventional investments, alternatives are often characterized by lower correlation to market movements, providing investors with diversification and potential downside protection.

Types of Alternative Investments

The world of alternative investments is vast and encompasses a wide array of asset classes, including:

4.1 out of 5

| Language | : | English |

| File size | : | 4477 KB |

| Print length | : | 144 pages |

| Screen Reader | : | Supported |

- Private Equity: Investments in privately held companies, allowing investors to participate in the growth potential of businesses not listed on public exchanges.

- Venture Capital: A subtype of private equity that invests in early-stage companies with high growth potential.

- Hedge Funds: Actively managed funds that employ sophisticated investment strategies and often target specific markets or sectors.

- Commodities: Investments in tangible assets such as precious metals, agricultural products, and energy.

- Infrastructure: Investments in projects related to transportation, utilities, and telecommunications.

- Private Debt: Loans made to private entities that provide regular income streams and offer potential diversification benefits.

li>Real Estate: Investments in physical properties, ranging from residential and commercial buildings to land and natural resources.

Benefits of Alternative Investments

Incorporating alternative investments into a portfolio can offer several advantages:

- Diversification: Alternatives often exhibit low correlation to traditional investments, reducing overall portfolio risk.

- Downside Protection: Hedge funds and other alternative investments can provide downside protection during market downturns.

- Enhanced Returns: Some alternative investments, such as private equity and venture capital, have the potential to generate higher returns than traditional asset classes.

- Income Generation: Investments in real estate and private debt can provide regular cash flows, supplementing portfolio income.

- Inflation Hedge: Commodities and real estate have historically served as inflation hedges, protecting against purchasing power loss.

- Liquidity: Some alternative investments, such as private equity and real estate, may have limited liquidity, making it difficult to access funds quickly.

- Fee Structures: Alternative investments often involve higher fees than traditional investments, which can erode returns.

- Complexity: Understanding and evaluating alternative investments can be complex, requiring professional advice.

- Volatility: Some alternative investments, such as hedge funds and commodities, can experience significant volatility, leading to potential losses.

- Lack of Regulation: Certain alternative investments, such as hedge funds, may not be subject to the same level of regulation as traditional investments, increasing the risk of fraud or mismanagement.

- Long Investment Horizon: Alternative investments often require a long holding period to realize full potential.

- High Net Worth: Alternatives typically involve higher minimum investment thresholds than traditional investments.

- Risk Tolerance: Investors should have a high tolerance for risk and be prepared for potential losses.

- Investment Knowledge: A strong understanding of investments and alternative asset classes is essential for informed decision-making.

- Professional Guidance: It is highly recommended to seek professional advice from financial advisors or investment managers specializing in alternative investments.

Risks of Alternative Investments

While alternative investments can offer potential benefits, they also come with certain risks:

Suitability for Investors

Alternative investments are not suitable for all investors. They are generally recommended for sophisticated investors with the following characteristics:

Alternative investments offer a diverse range of asset classes that can enhance portfolio performance and reduce risk. However, they come with certain risks and should be carefully considered in consultation with a financial advisor. For sophisticated investors with a long investment horizon and high risk tolerance, alternative investments can provide opportunities for diversification, downside protection, and enhanced returns.

4.1 out of 5

| Language | : | English |

| File size | : | 4477 KB |

| Print length | : | 144 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Story

Story Paperback

Paperback Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Bibliography

Bibliography Foreword

Foreword Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Reference

Reference Encyclopedia

Encyclopedia Thesaurus

Thesaurus Resolution

Resolution Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Stacks

Stacks Archives

Archives Reserve

Reserve Journals

Journals Rare Books

Rare Books Special Collections

Special Collections Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Storytelling

Storytelling Reading List

Reading List Theory

Theory R L Medina

R L Medina Jason B West

Jason B West Toni C

Toni C Jenni Kosarin

Jenni Kosarin Thomas J Brodeur

Thomas J Brodeur Gerald Schwetje

Gerald Schwetje Mike Anderson

Mike Anderson Ken Wilber

Ken Wilber George L Thomas

George L Thomas Erika Knight

Erika Knight Natalie Barelli

Natalie Barelli Paulo Coelho

Paulo Coelho John Tirman

John Tirman Bob Marks

Bob Marks Jennie Nicole

Jennie Nicole Ledecky Fun Press

Ledecky Fun Press Tom Kendrick

Tom Kendrick Zoe Mellors

Zoe Mellors Jacqueline Lambert

Jacqueline Lambert Wendy Liu

Wendy Liu

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Desmond FosterThe Tragic Sinking of the Royal George: A Harrowing Tale of Maritime Disaster...

Desmond FosterThe Tragic Sinking of the Royal George: A Harrowing Tale of Maritime Disaster...

E.E. CummingsUnveiling the Wonders of [Destination]: A Comprehensive Guide to What to See,...

E.E. CummingsUnveiling the Wonders of [Destination]: A Comprehensive Guide to What to See,... Dalton FosterFollow ·4.5k

Dalton FosterFollow ·4.5k Chase MorrisFollow ·3.3k

Chase MorrisFollow ·3.3k Harold PowellFollow ·8k

Harold PowellFollow ·8k Jacques BellFollow ·6.5k

Jacques BellFollow ·6.5k Vic ParkerFollow ·12.8k

Vic ParkerFollow ·12.8k Dakota PowellFollow ·8.4k

Dakota PowellFollow ·8.4k Randy HayesFollow ·6.6k

Randy HayesFollow ·6.6k Esteban CoxFollow ·18.6k

Esteban CoxFollow ·18.6k

Carson Blair

Carson BlairMy Second Chapter: The Inspiring Story of Matthew Ward

In the tapestry of life, where threads...

Graham Blair

Graham BlairFull Voice Workbook Level Two: A Comprehensive Guide to...

The Full Voice Workbook Level Two is a...

Darren Blair

Darren BlairEmbark on an Unforgettable Adventure: Exploring the...

Prepare yourself for an extraordinary...

Isaiah Powell

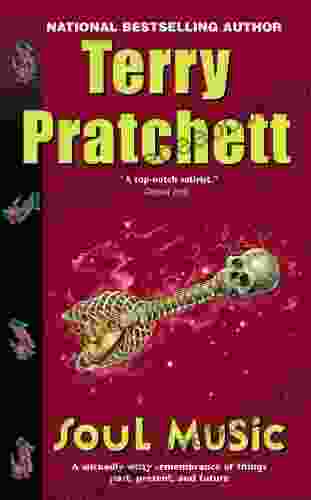

Isaiah PowellSoul Music: A Literary Odyssey Through Discworld

In the realm of fantasy...

4.1 out of 5

| Language | : | English |

| File size | : | 4477 KB |

| Print length | : | 144 pages |

| Screen Reader | : | Supported |